Apr calculator savings

Use this annual percentage rate calculator to determine the annual percentage rate or APR for your mortgage. APR or loan information posted by brokers.

Savings Calculator

This payday loan calculator will help you determine the actual annual percentage rate APR and total cost of a payday loan.

. The online Annual Percentage Yield program is a tool for verifying annual percentage yields pursuant to the Truth in Savings Act and its implementing. Help Contact Questions and Applications 1-888-KEY-0018. 000 Alternative calculators Select APR Calculator CIS Tax Deduction Calculator Company Car And Fuel Benefit-In-Kind Dividend Tax Calculator VAT Calculator Gross Profit Calculator Loan Calculator More Profit Calculator Mortgage Calculator Savings Calculator Stamp duty and tax calculator Startup Calculator.

Deposits are made at the beginning of each year. Press the View Report button for a full amortization schedule either by year or by. Home Lending Customer Service 1-800-422-2442.

When applying for a loan it is common for lenders to charge fees or points in addition to interest. Accuracy and completeness is not guaranteed. Bureau of Labor Statistics.

A down payment may be required. For example a 800 purchase could be split into 12 monthly payments of 7221 at 15 APR or 4 interest-free payments of 200 every 2 weeks. Finance Charges Added to loan amount Prepaid Finance Charges Paid Separately 51784 APR 53682.

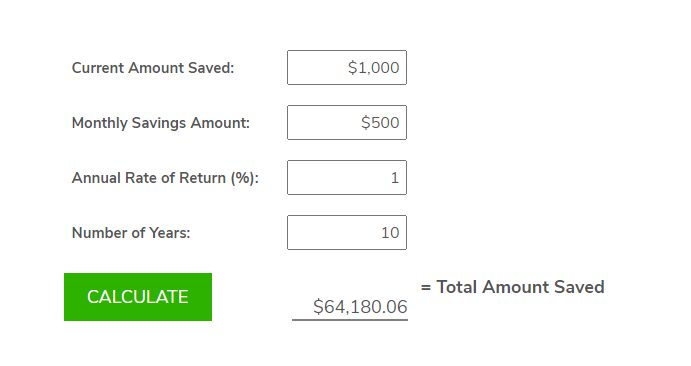

This calculator can help you determine the future value of your savings account. Publication 525 Taxable and Nontaxable Income. Rule of 72 Calculator.

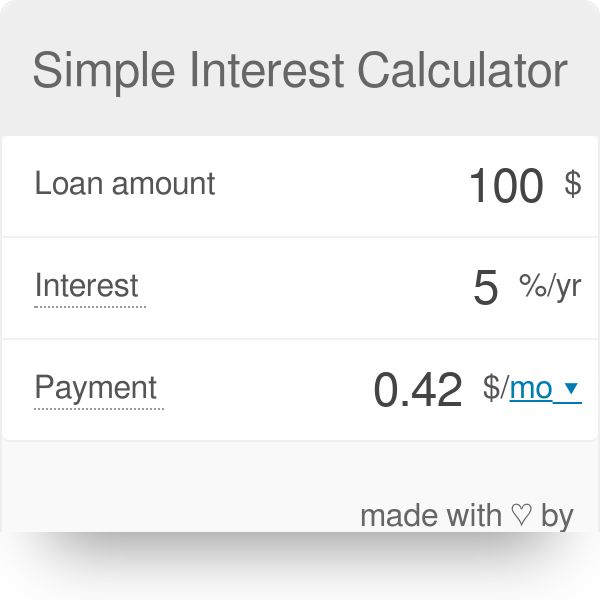

This 457 Savings Calculator is designed to help you make that prediction as accurately as possible. It is an excellent tool to estimate or compare the cost of taking out a payday loan with an alternative loan. The banking costs of a loan involve more than just interest rates.

Accessed Apr 25 2022. First enter your initial investment and the monthly deposit you plan to make. Explore personal finance topics including credit cards investments identity.

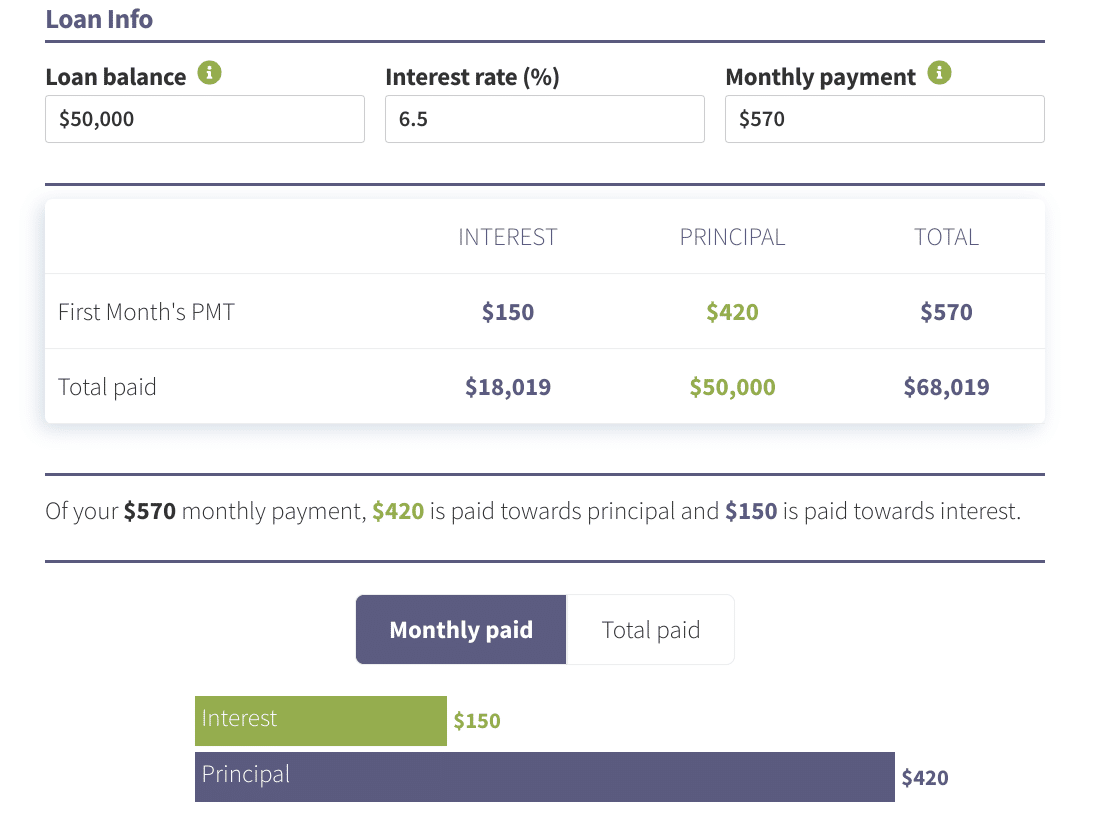

Our default assumptions include. Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a. The Loan Savings Calculator shows how FICO scores impact the interest you pay on a loan.

Express your APY as a decimal by dividing by 100. Data is obtained from public sources. Loan Amount Interest Rate Term.

Clients using a TDDTTY device. The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term. FBX is not liable for.

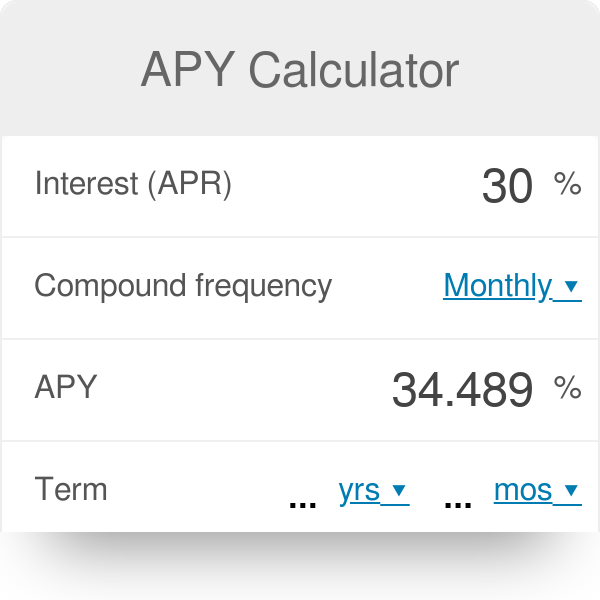

Your savings account pays 200 APY and you have a balance of 1000. Convert APR to APY. Financial emergencies can arise before payday and you might not have the funds to cover the extra expenses.

Options depend on your purchase amount may vary by merchant and may not be available in all states. The above calculator compounds interest yearly after each deposit is made. It not only takes into account your annual contributions projected return on investments and years until retirement but also allows you to figure in your anticipated growth in salary as well.

Accessed Apr 15 2022. Affirm savings accounts are held with Cross River Bank Member FDIC. This program includes relevant finance charge and APR tolerances for verifying the accuracy of annual percentage rates and finance charges on loans secured by real estate or a dwelling.

However if you want to learn how to calculate the APR here is a step-by-step guide on how to calculate the APR of a fixed-rate mortgage. For this example lets say you have a 330K mortgage with a 10-year-term a monthly payment of 1500 and that you paid 2000 in points and 2000 in origination fees. 100 1047 1047.

Our retirement savings calculator predicts your total retirement savings in todays amount then highlights how that amount might expand over the years you plan to spend in retirement with inflation taken into consideration. In comparison if a 100 savings account includes an APY of 1047 the interest received at the end of the year is. Select your loan type and state enter the appropriate loan details and choose your current FICO score range.

If you initially had 5000 saved up and wanted to deposit 1000 at the beginning of the second year then you would set the initial deposit amount to 4000 as the other 1000 would automatically be added at the. Then provide an annual interest rate and the number of months you would like to consider. How Our Retirement Calculator Predicts Your Savings.

Savings Calculator

Free Simple Savings Calculator Investinganswers

Savings Calculator Credit Karma

Savings Calculator Nerdwallet

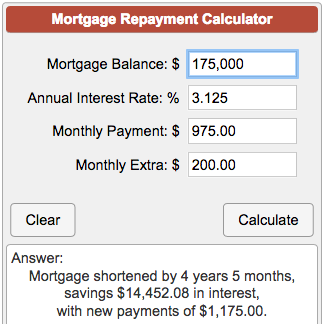

Mortgage Repayment Calculator

Simple Interest Calculator Audit Interest Paid Or Received

What Is Compound Interest And How Does It Work For Your Savings Ally

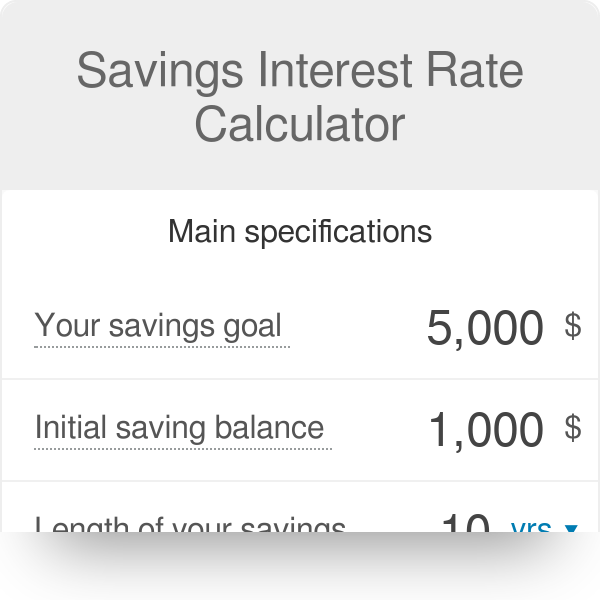

Savings Interest Rate Calculator

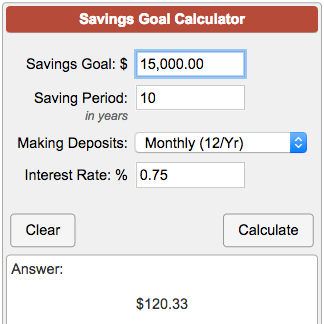

Savings Goal Calculator

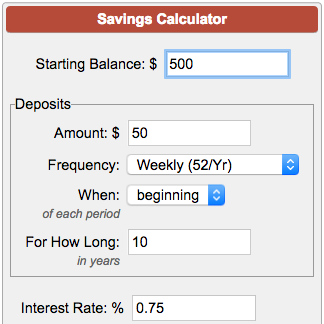

Savings Calculator Printable Periodic Savings Schedule

Savings Calculator

Student Loan Interest Calculator Student Loan Planner

Deposit Savings Calculator Apps On Google Play

Apy Calculator Annual Percentage Yield

Simple Interest Calculator Defintion Formula

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

Savings Calculator Printable Periodic Savings Schedule